Fulton Economic Development Corp. Executive Director Michael Ladd explores the difference between grants and loans, as well as the personal investment required for both, in this column submitted to WROI News on Giant.fm.

The lady on the other end of the phone asked me about that “free money the government is giving away for home repairs” and where could she apply.

I explained that if the government is involved, no matter what “it” is, it is not free. You are still going to have to put some of your own money into the project. There are no local grants for home repair while there are state programs. The Section 504 Home Repair program provides loans to very-low-income homeowners to repair, improve or modernize their homes or grants to elderly very-low-income homeowners to remove health and safety hazards.

I explained that if the government is involved, no matter what “it” is, it is not free. You are still going to have to put some of your own money into the project. There are no local grants for home repair while there are state programs. The Section 504 Home Repair program provides loans to very-low-income homeowners to repair, improve or modernize their homes or grants to elderly very-low-income homeowners to remove health and safety hazards.

A few phone calls later I took another one asking about grants to start up a business. “Love to oblige you, but there are no grants for that.” Again, just loans.

I must field a dozen such requests a month.

The best way to explain this is by using READI funds as an example. READI stands for the Rural Economic Acceleration and Development Initiative. According to the READI program website, READI is designed to spend “$500 million in state appropriations to promote strategic investments that will make Indiana a magnet for talent and economic growth. READI is expected to attract at least $2 billion of local public, private and philanthropic match funding that will propel investment in Indiana’s quality of place, quality of life and quality of opportunity.”

It is the match funding that is important to this discussion.

The match funds for READI are 1 to 1 to 3. That means, for every dollar the READI program hands out, the local government must match a dollar. But private investment must be $3. These three dollars can be cash or what is called “match.”

Some examples of possible sources of match include private developer investment, private company/industry investment, philanthropic investment, non-profit investment, CDFI loans, standard bank loan, or local government tax abatement. A CDFI is a community development financial institution. Read a bank or a credit union or a small business loan fund. The CDFI Fund’s purpose is to promote economic revitalization and community development in low-income communities through investment in and assistance to CDFIs.

The point is that even when the government seeks to “give away” money, there are always strings attached.

On another subject: the state is promoting another program that could be important to Fulton County. It has been named the Rural Empowerment and Development Program – RED for short.

RED is a planning program. Each participating local community will undergo a four- to six-month program tailored to their specific needs. Participants in each community or county that receives an award will identify and develop between five and 15 actionable projects. Each project team will have guidance and coaching to ensure successful implementation of its finalized plans. An additional “complex project” will be selected for study or a facilitated Solutions Charrette to tackle the project’s more challenging issues. This comprehensive approach allows communities to address immediate needs while building long-term capacity for sustained growth and development.

FEDCO is currently putting together the application. In part this will be a follow up to the Community Foundation’s “Conversations with Our Community” program in May of this year. And if Fulton County is one of the lucky three to receive an award from this program, we will move from discussing to planning and then to action.

Factory closures in Warsaw and Goshen leave hundreds without jobs

Factory closures in Warsaw and Goshen leave hundreds without jobs

Pizza Inn Corporation CEO Brandon Solano visits new Rochester location

Pizza Inn Corporation CEO Brandon Solano visits new Rochester location

Fulton County Republicans file for May Primary Wednesday

Fulton County Republicans file for May Primary Wednesday

FCPL to receive $10,000 gift from Carnegie Corporation of New York

FCPL to receive $10,000 gift from Carnegie Corporation of New York

Ron Shaffer named new Plymouth football coach, Dean of Students

Ron Shaffer named new Plymouth football coach, Dean of Students

Political candidates can begin filing this week

Political candidates can begin filing this week

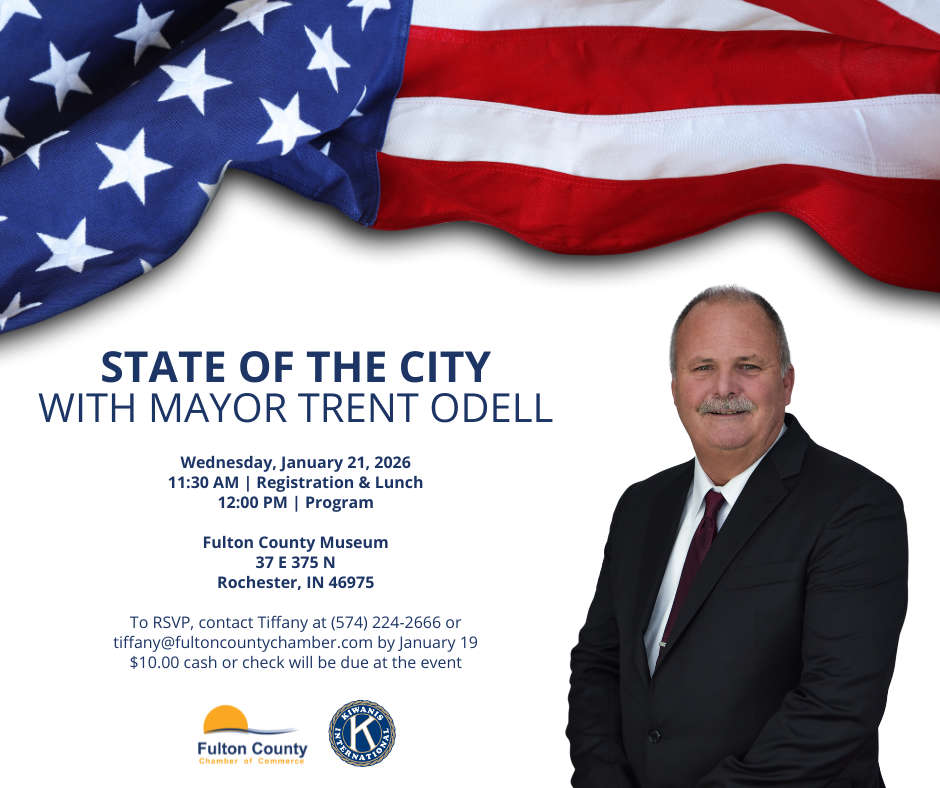

Rochester Kiwanis Club and Fulton County Chamber of Commerce to host State of the City

Rochester Kiwanis Club and Fulton County Chamber of Commerce to host State of the City

More than one-third of Christmas tree home fires occur in January

More than one-third of Christmas tree home fires occur in January