The U.S. Department of Agriculture (USDA) announced the final approximately $300 million in assistance to distressed direct and guaranteed farm loan borrowers under Section 22006 of the Inflation Reduction Act.

Over the past two years, USDA acted swiftly to assist distressed borrowers in retaining their land and continuing their agricultural operations. Since President Biden signed the Inflation Reduction Act into law in August 2022, USDA has provided approximately $2.5 billion in assistance to more than 47,800 distressed borrowers.

The assistance announced today is expected to provide $300 million in assistance to over 12,800 distressed direct and guaranteed Farm Loan Programs (FLP) borrowers.

“USDA has always been committed to standing by our nation’s farmers and ranchers, especially in their most challenging times,” said Agriculture Secretary Tom Vilsack. “The final round of payments announced today under President Biden’s Inflation Reduction Act provides much-needed relief to more than 12,800 producers, helping them stay on their land and continue farming. At USDA, we are not only addressing immediate financial challenges but also working every day to build a stronger, more supportive loan system that ensures farmers have the tools they need to succeed now and into the future.”

This round of automatic assistance includes approximately:

$168.5 million for payments in the amount of any outstanding delinquencies on qualifying direct loans as of Nov. 30, 2024, for direct borrowers one or more days delinquent as of that date, and in the amount of any outstanding delinquencies, as of Sept. 30, 2024, on qualifying guaranteed loans of guaranteed borrowers one or more days delinquent or flagged for liquidation on a qualifying loan as of that date (including those who received prior IRA 22006 assistance).

$5 million for payments in the amount of any outstanding delinquencies on qualifying guaranteed loans as of Sept. 30, 2024, for guaranteed borrowers who were delinquent as of Sept. 30, 2024, on a qualifying loan but by fewer than 30 days and were therefore not eligible for the assistance announced on Oct. 7, 2024.

$67.3 million for payment of the next installment due on all FLP direct loans for borrowers that received direct borrower delinquency assistance under IRA 22006 announced on Oct. 7, 2024, not to exceed the remaining balance.

$35 million for payment in the amount of the next installment due on qualifying direct loans for borrowers that restructured or who have accepted an offer to restructure, a qualifying direct loan between March 27, 2023, and today through primary loan servicing available through FSA. This assistance will be equal to the amount of the next installment (first applied toward any delinquency) for all qualifying direct loans held by the borrower, not to exceed the remaining balance. For any borrowers who have accepted an offer to restructure, payment will be equal to the next installment for all qualifying direct loans post-restructure, not to exceed the remaining balance.

$9 million for the payment of outstanding direct Emergency Loans as of Nov. 30, 2024.

$4.1 million in assistance for borrowers of qualifying direct loans with protective advances outstanding as of Nov. 30, 2024, and borrowers of qualifying guaranteed loans with protective or emergency advances as of Sept. 30, 2024. Protective advances are defined in 7 C.F.R. 761.2 and are those made consistent with 7 C.F.R. 765.203 or 762.149; emergency advances are those made consistent with 7 C.F.R. 762.146(a)(3). For direct loan borrowers, payments will be in the amount of the outstanding protective advance as of Nov. 30, 2024, where possible based on the structure of the account. For guaranteed loan borrowers, payments will be in the amount of the outstanding protective or emergency advance balance as of Sept. 30, 2024, where possible based on the structure of the account.

$3.9 million for payment of outstanding interest for direct borrowers whose interest exceeds their principal debt owed as of Nov. 30, 2024.

$1.8 million for payment of outstanding Economic Emergency (EE) loans for borrowers who have both EE loans and qualifying Consolidated Farm and Rural Development Act loans as of Nov. 30, 2024.

$109,000 for the payment of outstanding non-capitalized interest for all direct borrowers as of Nov. 30, 2024.

FLP payment eligibility is determined on a loan-by-loan basis. Distressed borrowers may be able to receive assistance under multiple categories if they have multiple direct or guaranteed loans that qualify, however each qualifying loan may only receive one payment. FLP direct and guaranteed borrowers who have a loan that qualifies under multiple categories of assistance above will receive a payment on that loan based on the option that provides the greatest payment amount, except in cases where the loan is eligible for payment of non-capitalized interest, which can be applied to that loan along with another assistance category.

Any distressed direct and guaranteed borrowers who qualify for these forms of assistance and are currently in bankruptcy will be addressed using the same case-by-case review process announced in October 2022 for complex cases.

While FSA does not at this time anticipate having remaining funds available for additional assistance under IRA Section 22006 after each type of assistance above is issued, if any funds remain at that time, FSA will make a payment on a prorated basis by loan and subject to the availability of funds towards the next installment due on all FLP direct loans, not to exceed the remaining balance, for borrowers who both (i) have direct loans that qualified for assistance under the first bullet above; and (ii) have not received IRA 22006 assistance prior to this announcement. If full next installment payments are made to borrowers who meet (i) and (ii) above, and funds remain available, FSA will provide the same installment assistance on a prorated basis by loan and subject to the availability of funds to borrowers who meet (i) but have received prior IRA 22006 assistance.

Farm Loan Programs Improvements

FSA recently announced significant changes to Farm Loan Programs through the Enhancing Program Access and Delivery for Farm Loans rule. Distressed FLP direct loan borrowers may benefit from the Distressed Borrower Set-Aside program included in the regulation update, which allows qualifying distressed borrowers to set aside up to a full loan installment on certain loans, at a reduced .125% interest rate. This policy change and many others included in the rule are designed to expand opportunities for borrowers to increase profitability and be better prepared to make strategic investments in the enhancement or expansion of their agricultural operations.

FSA also has a significant initiative underway to streamline and automate the Farm Loan Program customer-facing business process. FSA has made several impactful improvements including:

The Loan Assistance Tool that provides customers with an interactive online, step-by-step guide to identifying the direct loan products that may be a fit for their business needs and to understanding the application process.

The Online Loan Application, an interactive, guided application that is paperless and provides helpful features including an electronic signature option, the ability to attach supporting documents such as tax returns, complete a balance sheet and build a farm operating plan.

An online direct loan repayment feature that relieves borrowers from the necessity of calling, mailing, or visiting a local USDA Service Center to pay a loan installment.

A simplified direct loan paper application, reduced from 29 pages to 13 pages.

A new educational hub with farm loan resources and videos.

The Distressed Borrowers Assistance Network, a national initiative aimed at providing personalized support to financially distressed farmers and ranchers. The network connects borrowers with individualized assistance to help them regain financial stability.

USDA encourages producers to reach out to their local FSA farm loan staff to ensure they fully understand the wide range of loan and servicing options available to assist with starting, expanding, or maintaining their agricultural operation. To conduct business with FSA, producers should contact their local USDA Service Center.

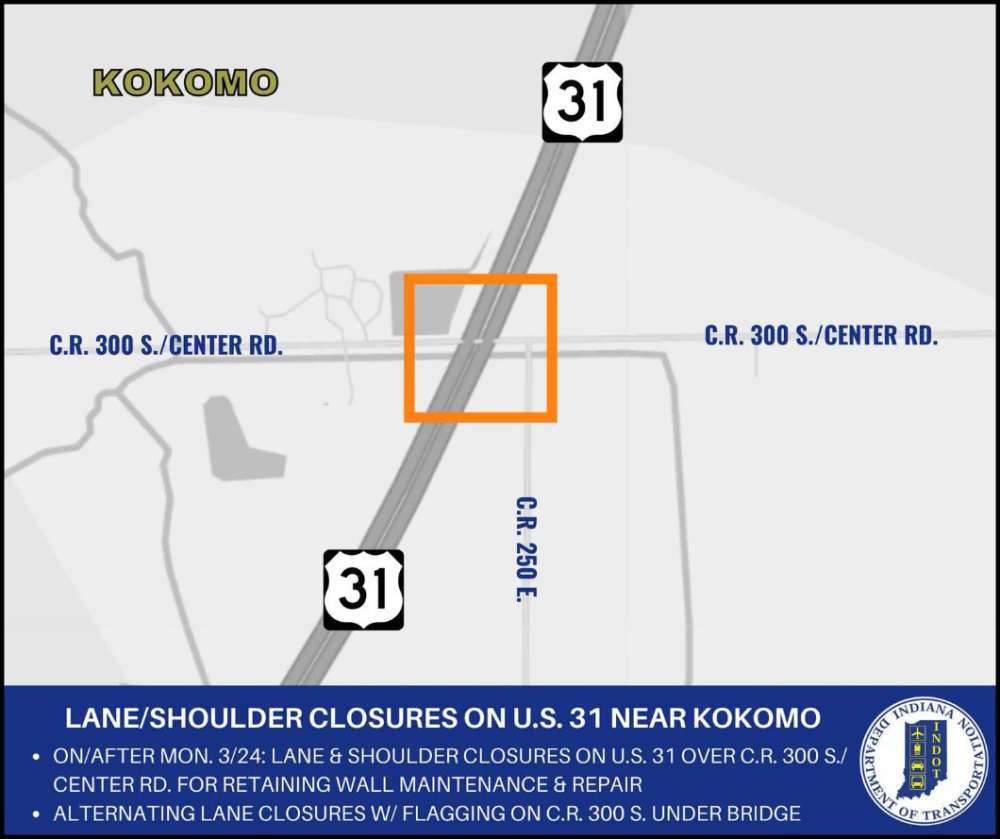

Lane and shoulder closures planned on U.S. 31 over C.R. 300 S. near Kokomo

Lane and shoulder closures planned on U.S. 31 over C.R. 300 S. near Kokomo

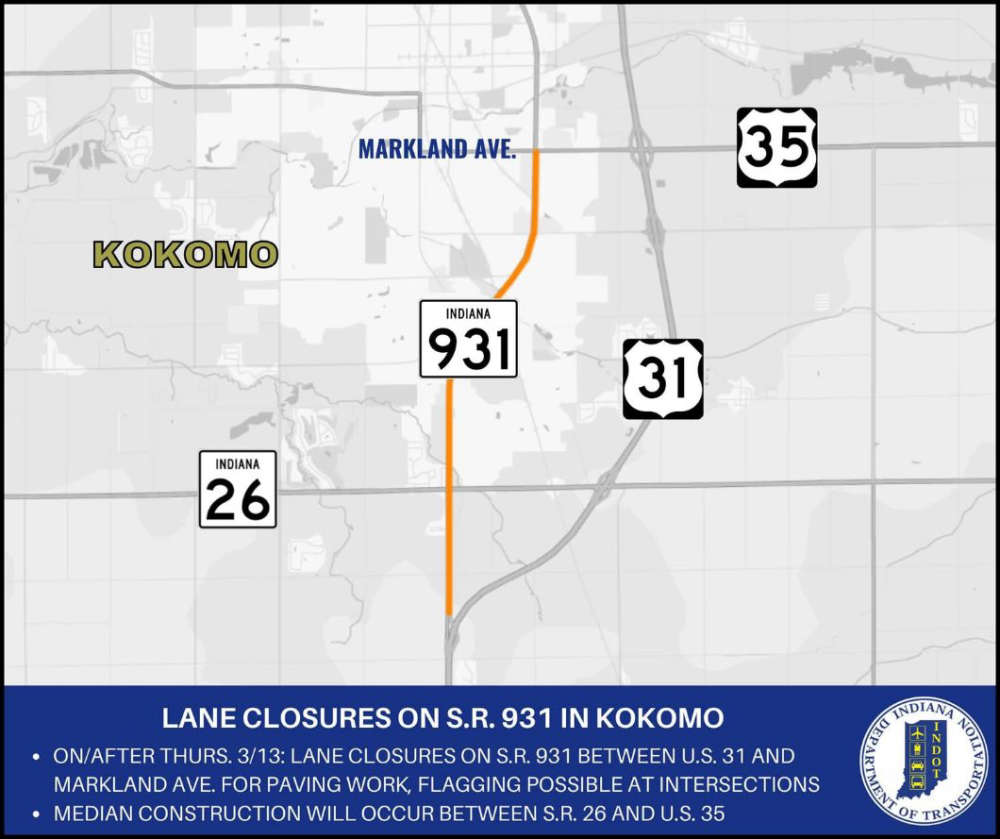

Lane closures begin this week on S.R. 931 in Kokomo

Lane closures begin this week on S.R. 931 in Kokomo

Prepare now for severe weather threat starting Friday

Prepare now for severe weather threat starting Friday

Woman killed, multiple injuries in car - bus crash

Woman killed, multiple injuries in car - bus crash

Fire, death under investigation

Fire, death under investigation

National Weather Service to issue a test tornado warning alert on Tuesday

National Weather Service to issue a test tornado warning alert on Tuesday

Logansport officer faces charges of neglect

Logansport officer faces charges of neglect

What you need to know about shingles

What you need to know about shingles