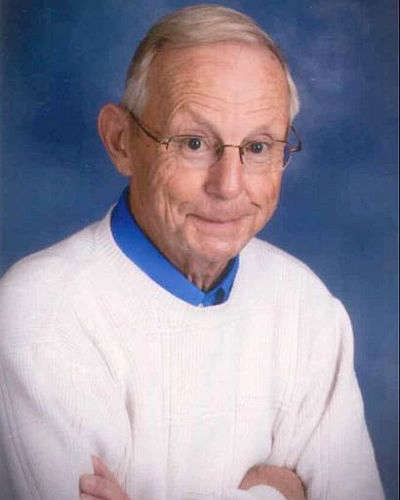

Today Governor Mike Braun announced the signing of an executive order aimed at removing ‘marriage penalties’ - or policies that disincentivize marriage.

Executive Order 25-51: Removing Government-Imposed Tax Penalties on Marriage

“Marriage is the fundamental cornerstone of strong families and strong communities, and we need to make sure Indiana’s tax and benefits systems aren’t penalizing Hoosiers for getting married. Signed in time for Tax Day, this executive order will make sure Indiana’s policies are providing an incentive for Hoosiers to build strong families, rather than getting in the way.” — Governor Mike Braun

Marriage is the foundation of families and communities and has clear economic benefits as well: married people earn more over their lifetime, and data analytics research has found that the top predictor of upward mobility for children was the number of intact families around them.

Marriage rates around the country are on the decline, and though Indiana has the 15th highest marriage rate in the country, there is more we can do to remove marriage penalties.

Indiana’s tax system disadvantages married couples in many ways, including exemption caps that remain the same for single and married filing jointly taxpayers.

An initial review of Indiana’s tax and benefits policies found multiple instances of policies that may be disincentivizing marriage. For example, a single filer can deduct up to $3,000 in rent, but a married couple filing jointly also gets only $3,000—not double. Also, a single filer and a married couple get the same $1,500 max credit on 529 contributions.

This executive order directs the Indiana Department of Revenue and all executive state agencies that administer welfare or benefit programs to evaluate and identify laws or policies that disadvantage married couples.

Agencies must provide detailed reports by July 1, 2025 (for tax policies) and July 1, 2026 (for benefit programs) with recommended changes that remove marriage penalties.

19 year old arrested for battery to a Prairie View Group Home employee

19 year old arrested for battery to a Prairie View Group Home employee

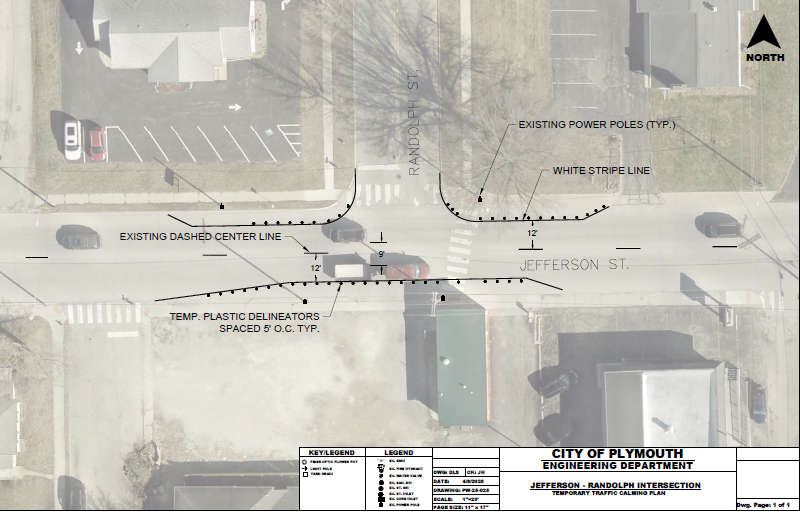

Plymouth Board of Public Works & Safety approves tatical urbanism project at Jefferson & Randolph

Plymouth Board of Public Works & Safety approves tatical urbanism project at Jefferson & Randolph

March 2025 Marshall County Jail and Sheriff's Department reports

March 2025 Marshall County Jail and Sheriff's Department reports

County Police investigate single-vehicle accident on Michigan Road, south of Tyler, minor injuries

County Police investigate single-vehicle accident on Michigan Road, south of Tyler, minor injuries

Town of Walkerton unveils first electric police vehicle in the region

Town of Walkerton unveils first electric police vehicle in the region

Neff arrested by city police for domestic battery, resisting, & disorderly conduct

Neff arrested by city police for domestic battery, resisting, & disorderly conduct

INDOT crews deploy to Michigan to assist with ice storm cleanup

INDOT crews deploy to Michigan to assist with ice storm cleanup