The IN Treasurer of State’s Office, in fulfillment of its duty to safeguard the interests of its citizens and uphold fiduciary standards, presented its findings.

BlackRock, Inc. is making an Environmental, Social, and Governance (“ESG”) commitment under Indiana law and has placed BlackRock on a watchlist pending further action by the Indiana Public Retirement System (INPRS) and its Board of Trustees.

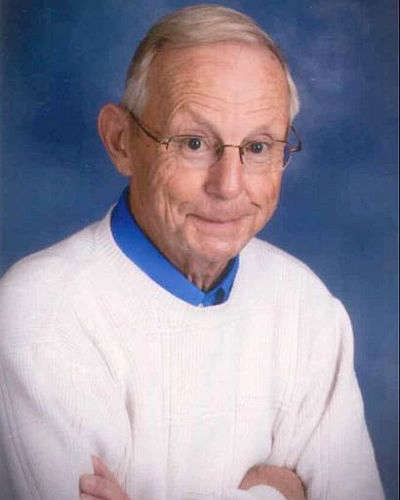

“We shouldn’t accept actions that put Hoosier retirees at risk,” said Treasurer Daniel Elliott. “ESG commitments hurt investments when employed by financial institutions. We must protect our public servants from having their hard-earned savings affected by ESG decisions made by large corporations such as BlackRock.”

Among the key points raised by the Treasurer’s Office:

– BlackRock’s disclosure reveals that the company prioritizes risky ESG engagement over its fiduciary duty to its clients.

– The company acknowledges that reliance on third-party providers for ESG data, which may be disclaimed for accuracy and completeness, poses significant risks to its earnings.

– BlackRock’s actions and commitment to “promoting ESG investing” are seen as potential threats to its reputation and its ability to attract and retain clients, as outlined in its own disclosures to the federal government.

-BlackRock’s membership in the NetZero Asset Management Initiative shows a commitment to ESG despite BlackRock’s claims otherwise.

“The General Assembly tasked me with safeguarding Indiana pensioner’s assets from non-fiduciary actions,” said Treasurer Elliott. “Today we have begun the process of reevaluating BlackRock’s role within our pension and retirement system”

The Treasurer of State received statutory authority to place Service Providers for INPRS on a watchlist after the General Assembly passed HEA 1008 in 2023. This bill was authored by Rep. Ethan Manning. The Treasurer of State is a separately elected constitutional officeholder who serves on the INPRS board ex-officio.

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

County Police arrest Grand Rapids man for driving without a license

County Police arrest Grand Rapids man for driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

Bourbon teen arrested, driving 102 MPH on U.S. 30

Bourbon teen arrested, driving 102 MPH on U.S. 30

Marshall County Communiity Foundation awards spring 2025 grants

Marshall County Communiity Foundation awards spring 2025 grants

Become a lifesaving volunteer by giving blood with the Red Cross

Become a lifesaving volunteer by giving blood with the Red Cross

Motorists: stay alert and share the road with farm equipment this spring

Motorists: stay alert and share the road with farm equipment this spring

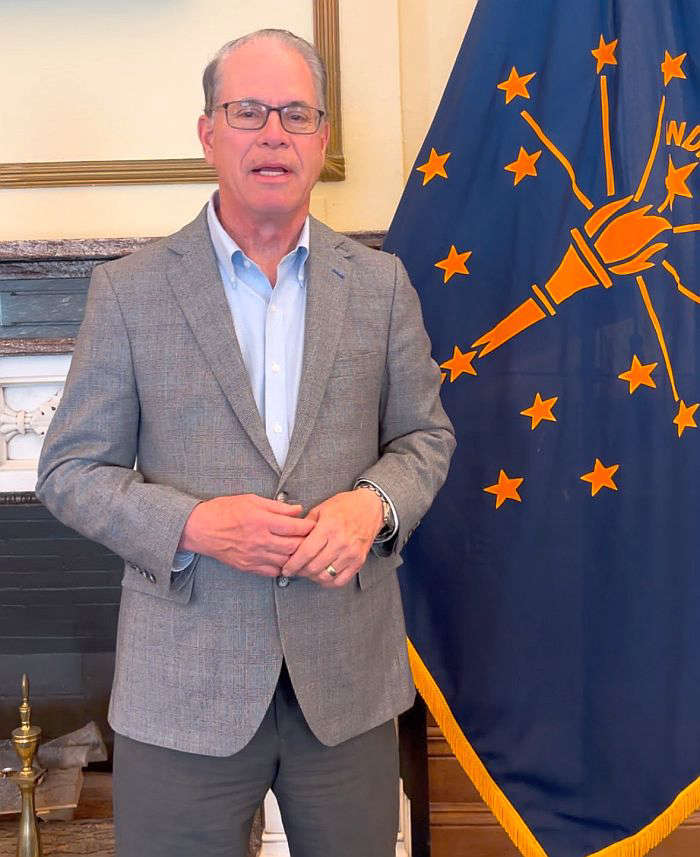

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’