Wednesday, Congressman Rudy Yakym (IN-02) released a statement after voting in favor of the Pandemic Unemployment Fraud Enforcement Act (H.R. 1156):

“Pandemic unemployment fraud cost taxpayers at least $135 billion,” Rep. Yakym said. “While the Democrats favor letting these fraudsters off the hook by allowing the statute of limitations to expire, this bill ensures accountability by extending it. It gives the Justice Department ample time to prosecute those responsible. This bill is a crucial step towards eliminating waste, fraud, and abuse, recovering taxpayer dollars, and increasing transparency between the federal government and hardworking Hoosiers."

The full text of the bill can be found here.

Before H.R. 1156 was passed, Congressman Yakym spoke on the floor in support of this bill.

Background:

The statute of limitations for prosecuting fraud in COVID-era pandemic unemployment insurance (UI) programs starts to expire on March 27, 2025. After this date, Congress cannot retroactively change the statute of limitations on criminal prosecutions.

Legislation is needed to extend the statute of limitations to enable federal law enforcement to continue pursuing more than $100 billion in fraudulent UI payments.

The Government Accountability Office (GAO) has estimated as much as $100-$135 billion in UI benefits were lost to fraud during the pandemic. Less than 4% of funds have been recovered.

In 2022, Congress similarly extended the statute of limitations for fraud in the Paycheck Protection Program and Economic Injury and Disaster Loans to 10 years.

The Pandemic Unemployment Fraud Enforcement Act (H.R. 1156):

- Extends the statute of limitations for criminal prosecution and civil enforcement actions in pandemic unemployment programs from 5 to 10 years to hold fraudsters accountable and recover taxpayer dollars.

- The Congressional Budget Office estimates that states will incur additional administrative costs for recordkeeping as a result of extending the statute of limitations. H.R. 1156 offsets this by rescinding $5 million in unobligated prior year funds made available to the Department of Labor for fraud prevention.

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

County Police arrest Grand Rapids man for driving without a license

County Police arrest Grand Rapids man for driving without a license

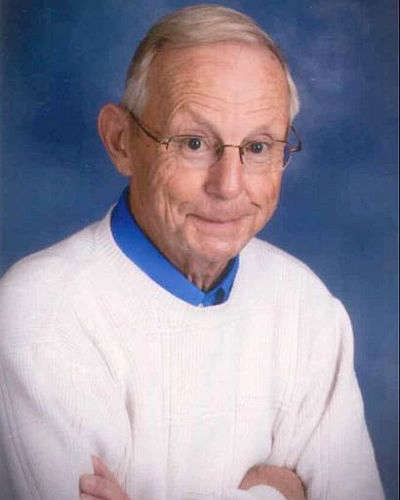

66-year-old Plymouth man arrested for intentionally driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

Bourbon teen arrested, driving 102 MPH on U.S. 30

Bourbon teen arrested, driving 102 MPH on U.S. 30

Marshall County Communiity Foundation awards spring 2025 grants

Marshall County Communiity Foundation awards spring 2025 grants

Become a lifesaving volunteer by giving blood with the Red Cross

Become a lifesaving volunteer by giving blood with the Red Cross

Motorists: stay alert and share the road with farm equipment this spring

Motorists: stay alert and share the road with farm equipment this spring

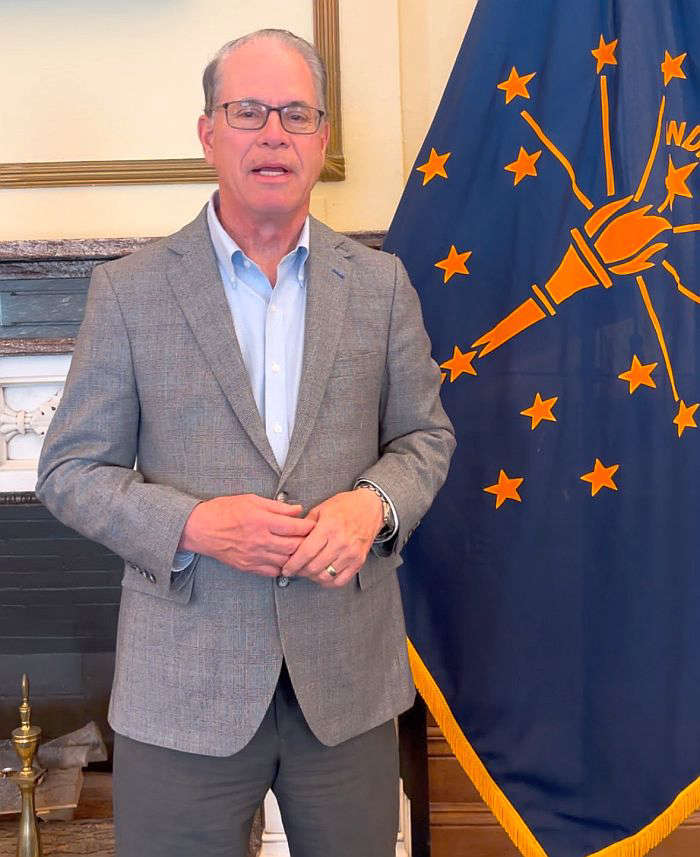

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’