As Indiana recognizes March Disability Awareness Month, the Treasurer of State’s Office celebrates a year of tremendous growth and new opportunities for INvestABLE Indiana, the state’s Achieving a Better Life Experience (ABLE) savings program. Designed to help individuals with disabilities save without jeopardizing critical benefits, such as Medicaid or Supplemental Security Income (SSI), INvestABLE Indiana now boasts over $23 million in assets under management (AUM), with account owners saving an average of $11,000 each.

“With more than 2,100 Hoosiers using INvestABLE accounts, it’s clear folks are taking the reins on their financial future,” said Indiana Treasurer of State Daniel Elliott. “Hardworking Hoosiers with disabilities deserve the freedom to save without worrying about losing the benefits they rely on. This program makes sure they can do just that—build a nest egg while keeping a safety net.”

New Enhancements & Tax Incentives

This past year, INvestABLE Indiana introduced a Money Market investment option, giving account owners another low-risk way to grow their savings. Additionally, Indiana taxpayers who contribute to their own or a loved one’s INvestABLE account can now receive a 20% state tax credit, worth up to $500 on their total contributions.

Looking Ahead: Expanded Eligibility in 2026

A big change is coming: Starting January 1, 2026, the age of onset for ABLE eligibility will increase from 26 to 46 years old. This means millions more Americans, including 1 million veterans, will soon be eligible to take advantage of ABLE accounts.

“We’ve seen such positive changes with ABLE and it’s exciting that so many more Hoosiers will soon be eligible to add this to their toolbox. Traveling the state and hearing stories from account owners and their support systems on how this program is changing and improving lives is incredibly heartening,” said Amy Corbin, Executive Director of INvestABLE.

Claire, an INvestABLE account owner, shares that she used her account to pay for Erskine Green Training Institute (EGTI). Claire says, “my parents moved my 529 college fund into ABLE so I could attend EGTI. Another use is for medical and counseling appointments.”

As INvestABLE Indiana continues to grow, the Treasurer’s Office remains committed to giving Hoosiers with disabilities the tools they need to secure their financial future. To learn more or to open an account, visit in.savewithable.com.

Legislation to provide FFA, 4-H students with excused school absences heads to governor

Legislation to provide FFA, 4-H students with excused school absences heads to governor

60-year-old Plymouth woman arrested after accident for OWI

60-year-old Plymouth woman arrested after accident for OWI

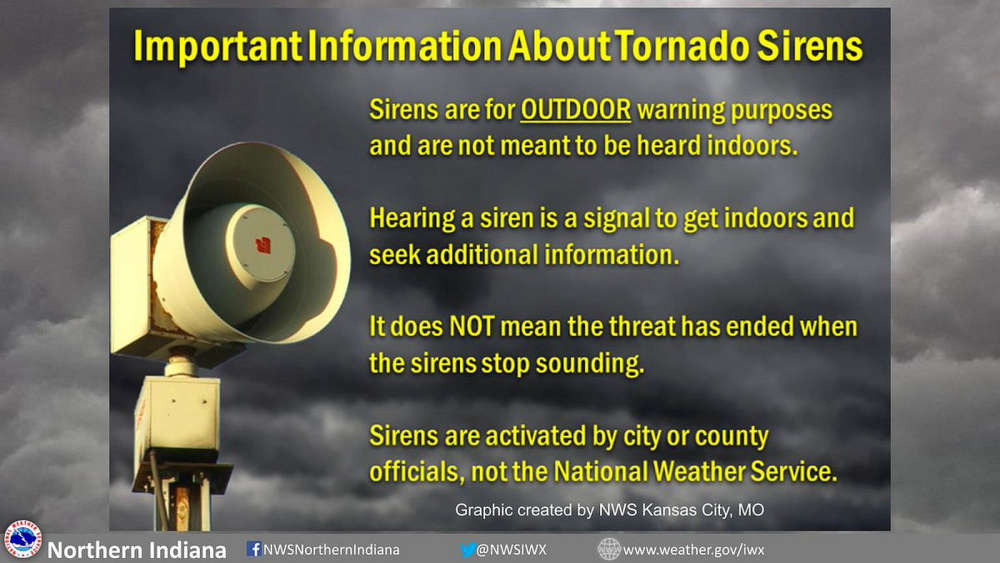

Marshall County EMA Director discusses warning sirens

Marshall County EMA Director discusses warning sirens

Brandyn Ross arrested for domestic battery, found hiding in upstairs bedroom

Brandyn Ross arrested for domestic battery, found hiding in upstairs bedroom

Mayor Listenberger declares April as Work Zone Awareness Month in Plymouth

Mayor Listenberger declares April as Work Zone Awareness Month in Plymouth

“Hoosiers Deserve Best-in-Class Customer Service” — Gov. Braun signs Executive Orders to Modernize BMV, Streamline Permitting in Transportation

“Hoosiers Deserve Best-in-Class Customer Service” — Gov. Braun signs Executive Orders to Modernize BMV, Streamline Permitting in Transportation

Representative Jack Jordan discusses visit at the Texas southern border

Representative Jack Jordan discusses visit at the Texas southern border

Indiana February 2025 Employment Report

Indiana February 2025 Employment Report