Marshall County Auditor Angie Birchmeier explained in the first article of the series an overview of the position of County Auditor. This second article in this series will dig deeper into those roles.

As a constitutional office, the position of county auditor can only be changed through a formal constitutional amendment process, unlike the offices that have powers given by the Indiana State Legislature. While the position of auditor does not have a policy-making role in county government, it is the responsibility of the auditor to follow those procedures set forth by not only the Indiana State Statutes but also by the executive branch of local government and to ensure compliance with the budgets set forth by the fiscal branch of local government.

The auditor works with all departments in the county as the official record keeper of the funds. As such the auditor and treasurer work in tandem daily to balance between the cash ledger and the funds ledger. All the money deposited into the county’s bank account is also accounted for in the fund's ledger and annually audited by the State Board of Accounts.

Additionally, other constitutional officers can have separate bank accounts that house trust funds or those not collected as a tax or fee. For example, the Clerk of the Circuit Court collects child support and judicial-related fines/fees that are held separately from the county’s funds, as well as the Sheriff, who has separate accounting for the inmate trust funds and commissary funds. Those accounts outside the official financial records of the auditor’s office are subject to the annual audit by the State Board of Accounts.

The various county departments receive money based on the fees for services set forth by Indiana State Statute or local ordinance, which are receipted into the various county funds. The department completes the required paperwork stating how much was received, whether cash, check, credit card, etc. and the fund into which the money will be deposited. That paperwork is brought to the auditor and treasurer’s offices to process, apart from those mentioned earlier.

Conversely, all money expended through accounts payable or payroll is processed in the Auditor and Treasurer’s offices. To ensure proper internal controls and oversight - checks and balances -the Auditor is responsible for starting any expense for the county, while the Treasurer is responsible for ensuring there is enough cash to cover the expense. This separation of duty is not only a requirement of the State Board of Accounts but also another way to make sure what comes in and goes out is accurate.

The Marshall County Building is open to the public from 8 a.m. to 4 p.m. Monday through Friday.

Residents can call 574-935-8555 with any questions or concerns.

M.C. Board of Finance meeting Tuesday at 8 a.m.

M.C. Board of Finance meeting Tuesday at 8 a.m.

Plymouth Police arrest 2 on Saturday

Plymouth Police arrest 2 on Saturday

Dustin's Place to host ______ & Me Dance, seeking community support

Dustin's Place to host ______ & Me Dance, seeking community support

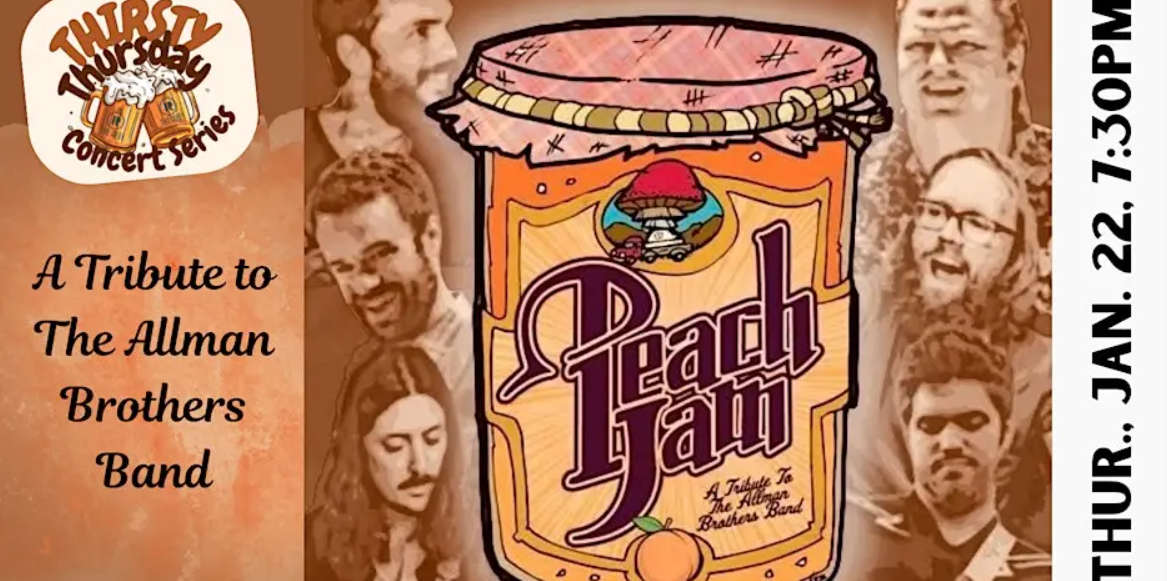

Peach Jam — A tribute to The Allman Brothers Band returns to the REES Theatre for Thirsty Thursday

Peach Jam — A tribute to The Allman Brothers Band returns to the REES Theatre for Thirsty Thursday

Plymouth wrestlers Balica and Smith fall in state title matches

Plymouth wrestlers Balica and Smith fall in state title matches

Marshall County under a Cold Weather Advisory 7 A.M. Monday to 9 A.M. Tuesday

Marshall County under a Cold Weather Advisory 7 A.M. Monday to 9 A.M. Tuesday

U.S. Seanotr Young, Shaheen introduce legislation to boost U.S. Critical Minerals Supply

U.S. Seanotr Young, Shaheen introduce legislation to boost U.S. Critical Minerals Supply

U.S. Rep. Yakym: “Taxpayer dollars should go to what works, not what wastes”

U.S. Rep. Yakym: “Taxpayer dollars should go to what works, not what wastes”