The Plymouth Common Council approved two tax abatements for local manufacturers Monday evening. Composite Technology Assemblies received a seven-year phased-in personal property abatement on an estimated $2.3 million capital investment at their Markley Avenue location. They will be installing a monorail track to improve the flow of production throughout the plant.

Composite Technology Assemblies will also be installing a cutoff robot to be used in the production of fiberglass tub and shower enclosures. Currently there are 55 employees at the Markley location and this investment will improve productivity and retain those employees.

Composite Technology Assemblies is part of Oasis Lifestyle and employs 338. Oasis is a locally owned and operated company with their corporate headquarters in Plymouth.

The second abatement that was approved Monday evening was for AK Industries, another locally owned and operated company that started in Marshall County. AK Industries is a leading producer of fiberglass and polyethylene products for the wastewater industry.

The $4.2 million estimated capital investment includes $3.2 million for a new structure to house a $1 million piece of equipment that will increase the production capacity of the facility. This new piece of equipment will add AK Industries to one of only 2 or 3 producers that can manufacture large diameter holding tanks in the country.

This investment will bring an additional 10 full-time positions to the 170 current employees. This will increase the payroll by an additional $700,000 per year, putting the total well over $11 million. While bringing additional jobs to Marshall County, protecting current jobs and improving the per capita income in the county is also of great importance. Most of this is done by working with and incentivizing industry already located in Marshall County.

“It is important in today’s business climate for a region to be seen as business friendly, when trying to attract new industry,” said Greg Hildebrand, President/CEO of Marshall County Economic Development Corporation. “With the online resources available to site selectors today, they can vet a community or county before they reach out to an area. Having a record of being consistent, reasonable, and friendly to business is important to industry looking to locate. There are a lot of risks and expenses involved in establishing manufacturing facilities.”

Both tax abatements are standard seven-year phased in abatements. The additional assessed value generated by these capital investments will be added gradually, over seven years, to the amount the companies pays property taxes on.

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

County Police arrest Grand Rapids man for driving without a license

County Police arrest Grand Rapids man for driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

Bourbon teen arrested, driving 102 MPH on U.S. 30

Bourbon teen arrested, driving 102 MPH on U.S. 30

Marshall County Communiity Foundation awards spring 2025 grants

Marshall County Communiity Foundation awards spring 2025 grants

Become a lifesaving volunteer by giving blood with the Red Cross

Become a lifesaving volunteer by giving blood with the Red Cross

Motorists: stay alert and share the road with farm equipment this spring

Motorists: stay alert and share the road with farm equipment this spring

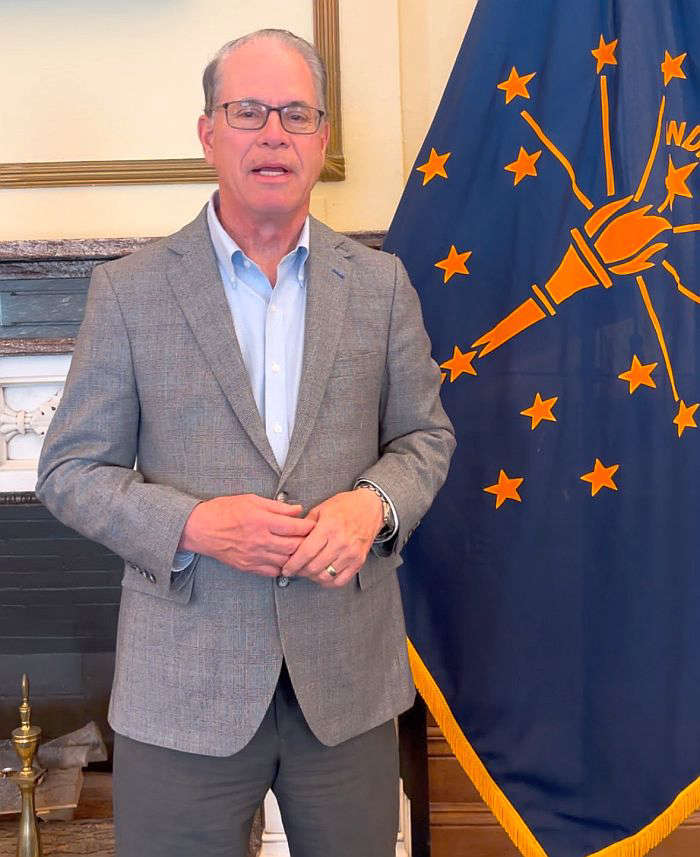

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’