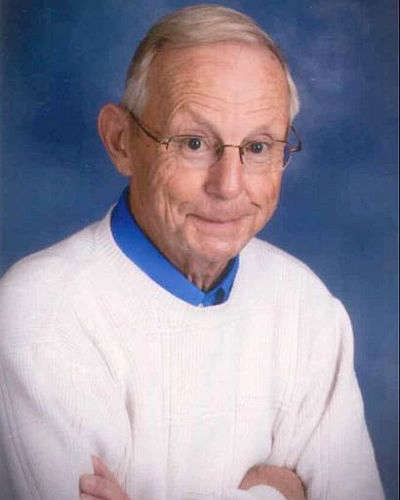

U.S. Senators Todd Young (R-Ind.) and Ben Cardin (D-Md.), both members of the Senate Finance Committee, introduced legislation to revitalize housing in distressed neighborhoods in Indiana, Maryland, and nationwide.

Currently, private development lacks in some urban and rural areas because the cost of purchasing and renovating homes is greater than the value of the sale price of homes. The Neighborhood Homes Investment Act (NHIA) creates a federal tax credit that covers the cost between building or renovating a home in these areas and the price at which they can be sold. The legislation also caps the price of sales for each home to ensure that they are affordable housing options in the community. The NHIA would also help existing homeowners in these neighborhoods to renovate and stay in their homes.

“Across Indiana, we have seen once-vibrant neighborhoods struggle under poor economic conditions and lack of investment. The Neighborhood Homes Investment Act would help restore these communities by directing private capital into neighborhoods in low-income census tracts, bridging the gap between the cost of renovation and neighborhood property values,” said Senator Young. “This legislation also includes important guardrails to ensure that tax incentives target the families that need it most, continuing the work to avoid the negative and lasting consequences that a lack of safe, affordable housing has on Hoosier families.”

“Everyone deserves a safe and affordable place to call home. Our bipartisan tax credit will drive housing investments and revitalize neighborhoods across Maryland while keeping them affordable for low- and moderate-income families,” said Senator Cardin. “This credit will allow individuals in these communities to build equity and wealth for their families. We must continue to make it more attractive to invest in the communities that need it most.”

Senators Ron Wyden (D-Ore.), Jerry Moran (R-Kan.), and Sherrod Brown (D-Ohio) were also original cosponsors.

“This bill takes a targeted approach to drive private investments in safe, affordable housing within struggling communities that need help the most, and it does it by wringing as much value as possible out of taxpayer dollars,” said Senator Wyden. “In an era when natural disasters like wildfires are posing greater dangers to cities and towns in Oregon, this bill also creates a new lifeline for communities hit by those disasters to get back on their feet. Even though Congress is sharply divided on a lot of issues, the cost of housing has been on the rise everywhere, and this bill is a testament to the bipartisan interest in addressing this challenge.”

“Investing in revitalizing homes will help bring new life to struggling communities across Kansas and provide affordable housing options for families,” said Senator Moran. “This legislation will help provide an incentive to restore declining neighborhoods and make the dream of homeownership more attainable for low-income Americans, particularly in rural communities.”

“Although the Fair Housing Act made housing discrimination illegal more than 50 years ago, too many of our communities - particularly Black and brown communities – still reflect historic patterns of segregation and racial disparities in wealth and homeownership,” said Senator Brown. “The Neighborhood Homes Investment Act will help overcome historic patterns of disinvestment in low-wealth neighborhoods and give families a chance to build wealth through homeownership in the communities they love.”

Investors, not the government, bear the risk – credits would be received only after rehabilitation is completed and the property is occupied by an eligible homeowner. The Treasury Department is required to provide an annual report on the performance of the program.

NHIA will require that homes constructed or revitalized under the program must be sold to homeowners making less than 140% of the area median income. This ensures that improved housing directly benefits members of the communities targeted by the new tax credit. In addition, these credits are only eligible for houses constructed or revitalized in census tracts that meet certain minimum metrics related to median gross income, poverty rates, and home sale prices.

The credits would only be available after the homes have been completed and sold to a homeowner. NHIA targets neighborhoods that have poverty rates that are 130% or greater than the metro or state rate; have incomes that are 80% or less than area median income; and have home values that are below the metro or state median value. The maximum credit amount is the lesser of the excess of development costs over the sales price, 35% of development costs, or 28% of the national median price for new homes.

NHIA tax credits are awarded to project sponsors—developers, lenders, or local governments—through a competitive statewide application process administered by each state’s housing finance agency. Sponsors would use the credits to raise investment capital for their projects, and the investors could claim the credits against their federal income tax when the homes are sold and occupied by eligible homebuyers. State agencies would have annual allocation of either $7 per capita or $9 million, whichever is higher.

The Neighborhood Homes Investment Act is supported by the following organizations:

BPC Action

Center For Community Progress

Coalition For Home Repair

Community Home Lenders of America

Community Preservation Corporation

Enterprise Community Partners

Grounded Solutions Network

Habitat For Humanity

Home By Hand

Homeownership Alliance

Housing Assistance Council

Housing Partnership Network

Independent Community Bankers of America

Local Initiatives Support Corporation

Low Income Investment Fund

Mortgage Bankers Association

National Alliance of Community Economic Development Associations

National Association of Affordable Housing Lenders

National Association of Hispanic Real Estate Professionals

National Association of Real Estate Brokers

National Association of Realtors

National Association of The Remodeling Industry

National Association of State and Local Equity Funds

National Community Reinvestment Coalition

National Community Stabilization Trust

National Council of State Housing Agencies

National Housing Conference

National Neighborworks Association

National Urban League

Prosperity Now

Rebuilding Together

Rocket Mortgage

Structured Finance Association

Unidos Us

Up For Growth Action

Full text of the Neighborhood Homes Investment Act can be found here.

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

County Police arrest Grand Rapids man for driving without a license

County Police arrest Grand Rapids man for driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

Bourbon teen arrested, driving 102 MPH on U.S. 30

Bourbon teen arrested, driving 102 MPH on U.S. 30

Marshall County Communiity Foundation awards spring 2025 grants

Marshall County Communiity Foundation awards spring 2025 grants

Become a lifesaving volunteer by giving blood with the Red Cross

Become a lifesaving volunteer by giving blood with the Red Cross

Motorists: stay alert and share the road with farm equipment this spring

Motorists: stay alert and share the road with farm equipment this spring

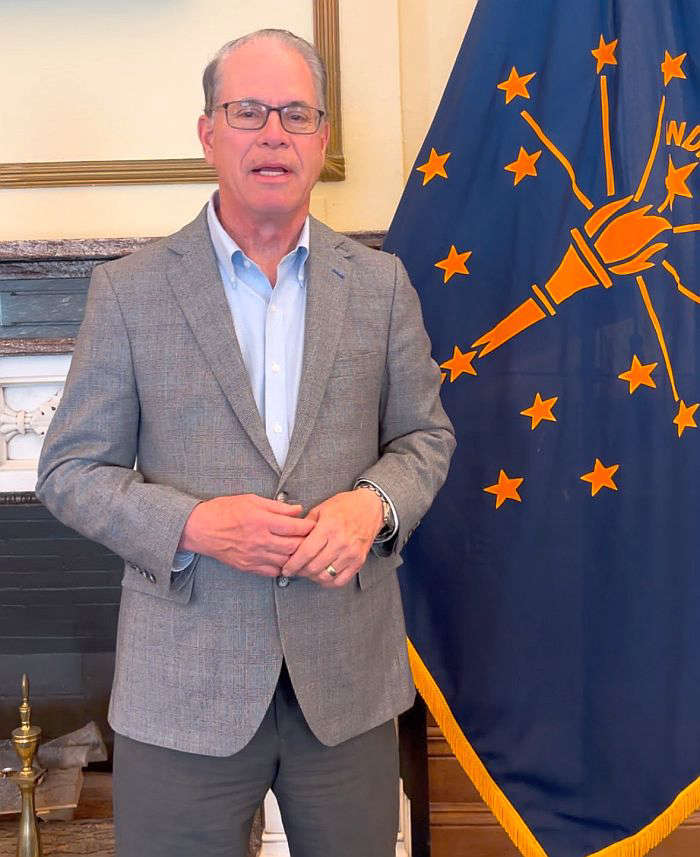

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’