Last week, U.S. Senators Todd Young (R-Ind.) and Raphael Warnock (D-Ga.) introduced the Barcode Automation for Revenue Collection to Organize Disbursement and Enhance (BARCODE) Efficiency Act, legislation that would help improve the processing of Internal Revenue Service (IRS) paper tax returns.

While the use of e-filing has grown exponentially since its inception, millions of taxpayers choose to file their returns each year on paper. By implementing technology like 2-D barcodes, the IRS will be able to conserve resources, minimize processing errors, and reduce delays in the distribution of refunds to taxpayers.

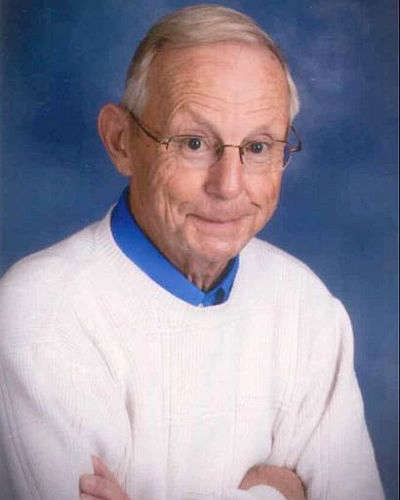

“Millions of Americans are forced to wait months – and sometimes years – for the IRS to process their tax returns,” said Senator Young. “Our bill will better serve taxpayers by improving the processing of paper returns, reducing errors, and requiring the IRS to operate more efficiently.”

“We live in an increasingly digital age, but our tax filing system hasn’t kept up for the millions of Americans who still use paper returns. This bill would help these filers get their refunds back as soon as possible,” said Senator Reverend Warnock. “I’m proud to introduce this bipartisan legislation with Senator Young and will keep working to improve the economic well-being of working families.”

The archaic, manual transcription process the IRS currently uses to process paper returns results in substantial delays and imposes significant costs on the agency. The BARCODE Efficiency Act would address these issues by requiring returns that are prepared electronically and filed on paper to include a scannable 2-D barcode that the IRS can use to convert the return information to a digital format.

Over the years, the National Taxpayer Advocate and the Government Accountability Office have made similar recommendations to the IRS to improve the processing of paper returns. The 2-D barcode technology has been used by state tax agencies for more than two decades and has been proven to be effective in accelerating the processing of tax returns. Optical character recognition or other functionally similar technologies will serve as a complement to 2-D barcoding to further assist with the processing of paper returns.

The Senate Finance Committee recently released a set of recommended common-sense fixes to improve IRS procedure and administration, which included the BARCODE Efficiency Act. Additionally, the bill aligns with the IRS’s focus to continue modernizing processing protocols.

Senator Young originally introduced the BARCODE Efficiency Act in 2024. The legislation builds on Senator Young’s work to address ongoing concerns about modernizing the IRS. In 2022, Senator Young and other Senate Finance Committee Republicans sent a letter to then-IRS Commissioner Charles Rettig to strongly encourage the agency to implement 2-D barcoding for paper returns in the 2023 tax filing season. Senator Young also sent a letter to then-IRS Commissioner Charles Rettig and penned an op-ed about processing delays at the IRS.

Full legislative text is available here. A one-pager on the bill is available here.

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

County Police arrest Grand Rapids man for driving without a license

County Police arrest Grand Rapids man for driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

Bourbon teen arrested, driving 102 MPH on U.S. 30

Bourbon teen arrested, driving 102 MPH on U.S. 30

Marshall County Communiity Foundation awards spring 2025 grants

Marshall County Communiity Foundation awards spring 2025 grants

Become a lifesaving volunteer by giving blood with the Red Cross

Become a lifesaving volunteer by giving blood with the Red Cross

Motorists: stay alert and share the road with farm equipment this spring

Motorists: stay alert and share the road with farm equipment this spring

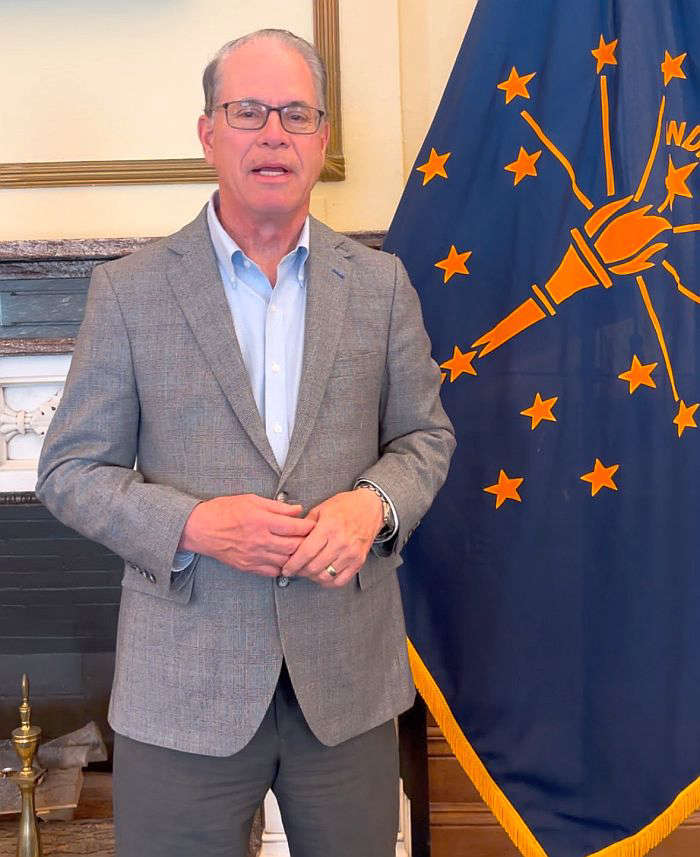

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’