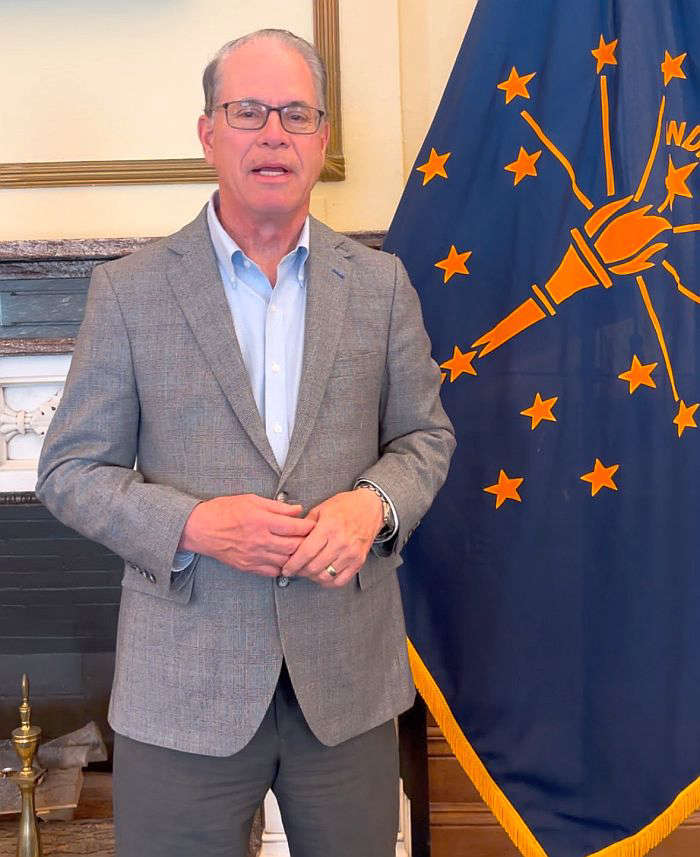

Senators Todd Young (R-Ind.), Mark R. Warner (D-Va.), John Thune (R-S.D.), and Catherine Cortez Masto (D-Nev.) applauded the passage of two bills to protect the privacy of Americans and remove burdensome health care reporting requirements by allowing certain communications to be filed electronically.

“Under current law, overreaching compliance requirements create uncertainty and stress for employers in Indiana and across the nation. Our bipartisan bills will help reduce these unnecessary burdens and increase efficiency,” said Senator Young.

“Health care for Americans has only gotten better and more accessible since the passage of the Affordable Care Act — just ask anyone who faced lifetime limits or was denied insurance because of a pre-existing condition. These two pieces of legislation will make needed adjustments to modernize and streamline ACA reporting requirements to ensure that they don’t needlessly compromise the privacy of Americans or get in the way of their access to health care. I’m proud to have introduced these pieces of legislation and look forward to seeing them signed by President Biden,” said Senator Warner.

“Small businesses in South Dakota and across the country have been forced to comply with overly burdensome administrative requirements from the Affordable Care Act,” said Senator Thune. “These bills would eliminate convoluted paperwork and streamline the current reporting requirements to ensure businesses can focus their resources on serving their customers and employees.”

“Employers shouldn’t have to jump through unnecessary hoops to provide health care coverage for their employees,” said Senator Cortez Masto. “These bills provide flexibility to employers, streamline health insurance reporting, and make communication more secure for employees and employers alike. I urge the president to sign them into law as soon as possible.”

The Employer Reporting Improvement Act will protect Americans’ privacy and ease compliance burdens on employers. Among other steps, it will modernize communication by allowing employers to electronically file certain documents. It will also protect privacy by clarifying that the IRS can accept full names and dates of birth in lieu of dependents’ and spouses’ Social Security numbers. In addition, it will ease compliance burdens by extending the time period (from 30 days to 90 days) during which an applicable large employer can appeal a penalty for not offering adequate, affordable health insurance to all full-time employees. Finally, it will enact a six-year statute of limitations for the IRS to levy penalties under the Employer Shared Responsibility provision of the ACA.

The Paperwork Burden Reduction Act will reduce the number of physical forms that employers have to mail to employees as part of complying with the ACA. Currently, employers and health insurance providers that provide minimum essential coverage must report this information to the IRS for each covered individual and provide a copy of this information to the covered individual (through 1095-B or 1095-C tax forms, depending on the coverage type) by January 31 of each year. Current IRS regulations allow employers to provide only 1095-B forms electronically. The Paperwork Burden Reduction Act will codify the current IRS policy by allowing the 1095-B to be provided electronically and would extend this to 1095-C, limiting unnecessary physical paperwork.

The Employer Reporting Improvement Act and the Paperwork Burden Reduction Act were approved by the U.S. House of Representatives earlier this year and now head to President Biden’s desk for his signature.

Full text of the Employer Reporting Improvement Act is available here. Full text of the Paperwork Burden Reduction Act is available here.

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

Board of Public Works & Safety confronted on VanVactor Drive name change, asked to change it back

County Police arrest Grand Rapids man for driving without a license

County Police arrest Grand Rapids man for driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

66-year-old Plymouth man arrested for intentionally driving without a license

Bourbon teen arrested, driving 102 MPH on U.S. 30

Bourbon teen arrested, driving 102 MPH on U.S. 30

Marshall County Communiity Foundation awards spring 2025 grants

Marshall County Communiity Foundation awards spring 2025 grants

Become a lifesaving volunteer by giving blood with the Red Cross

Become a lifesaving volunteer by giving blood with the Red Cross

Motorists: stay alert and share the road with farm equipment this spring

Motorists: stay alert and share the road with farm equipment this spring

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’

Governor Braun Announces Partnership between Indiana Excise Police, Indiana State Police to crack down on crime involving ‘nuisance bars’