Under the settlement, investors are eligible for a full refund of all monies and/or cryptocurrencies invested or deposited.

Indiana Secretary of State Diego Morales announces the Indiana Securities Division has joined multiple other states in settlement with GS Partners after more than a year of negotiations.

The settlement ensures Hoosiers will receive a return of all investments with GSB Group and GS Partners, regardless of the product or service they purchased from the respondents.

A working group of state securities regulators reached a multi-million-dollar settlement with GSB Gold Standard Corporation AG, GSB Gold Standard Bank LTD, and others doing business as “GS Partners.” and “GSB Group.” The offshore, online investment companies were alleged to have misled investors, violated securities laws, and engaged in fraud in connection with investments tied to digital and “metaverse assets”. State securities regulators alleged that investments were converted by the businesses, and investment products were “secured” by intangible assets.

Under the settlement, investors are eligible for a full refund of all monies and/or cryptocurrencies invested or deposited with GSB Group, GS Partners, and its affiliates, regardless of the product or service purchased from the respondents.

GS Partners, its affiliated companies, and its representatives claim to have over 800,000 investors from more than 170 countries and were close to completing $1 billion in transactions.

Questionable investments marketed by the companies included: G999 token, a digital asset deployed on a proprietary blockchain tied to physical gold; XLT Vouchers, a digital asset purportedly representing ownership interests in a skyscraper; and investments in a so-called staking pool in a metaverse known as Lydian World. The investigation also focused on the alleged sale of Elemental and Success Series Certificates, whereby purchasers were allegedly incentivized through gamification to continue to add more and more principal to their certificates to unlock variously passive income features, such as the payment of weekly or monthly passive income.

Resolution of this complex case was driven by the opportunity to provide significant financial relief to clients of GS Partners and other members of GSB Group. Hoosiers and residents of other participating jurisdictions who deposited principal with the respondents will be eligible to receive the value of their deposits, less the value of any withdrawals. The settlement applies to all products and services sold by the respondents.

“This action is reflective of the trend we are seeing increasingly in today’s securities markets that highlight a move away from pen and paper securities and a move towards securities that exist in digital formats such as the metaverse, A.I., cryptocurrency, etc. While many legitimate securities firms may leverage new technologies, it’s important for Main Street investors to recognize that investments in the real or digitalworld are regulated and subject to the same registration requirements,” said Diego Morales, Indiana Secretary of State.

Indiana residents who purchased any product or service from GS Partners, may contact the Indiana Secretary of State Securities Division for assistance with the claims process: (317) 232-6681 or via email at securities@sos.in.gov. Indiana Securities Division is eager to assist Hoosier investors.

The Indiana Securities Division encourages Indiana residents who invested with GS Partners to file a claim at Gold Standard Bank Settlement Program (gsbsettlement.com). Eligible GSB customers will be able to submit claims through the Claims Portal beginning in the coming weeks. The Claims submission process will last 90 days.

A list of required supporting documents is available online. The Securities Division encourages investors to begin preparing documentation prior to filing a claim.

IDVA offers grant opportunities for non-profit organizations serving the Indiana Veteran Community

IDVA offers grant opportunities for non-profit organizations serving the Indiana Veteran Community

Gov. Braun activates Indiana National Guard to aid in storm recovery

Gov. Braun activates Indiana National Guard to aid in storm recovery

Greencastle Police add second K9, embarks on SRO officer for Greencastle Schools

Greencastle Police add second K9, embarks on SRO officer for Greencastle Schools

Greencastle, Putnam County dodges major storm damage

Greencastle, Putnam County dodges major storm damage

GPD staying busy with construction traffic

GPD staying busy with construction traffic

Greencastle man arrested for public nudity

Greencastle man arrested for public nudity

Danville man killed by downed power lines at crash scene

Danville man killed by downed power lines at crash scene

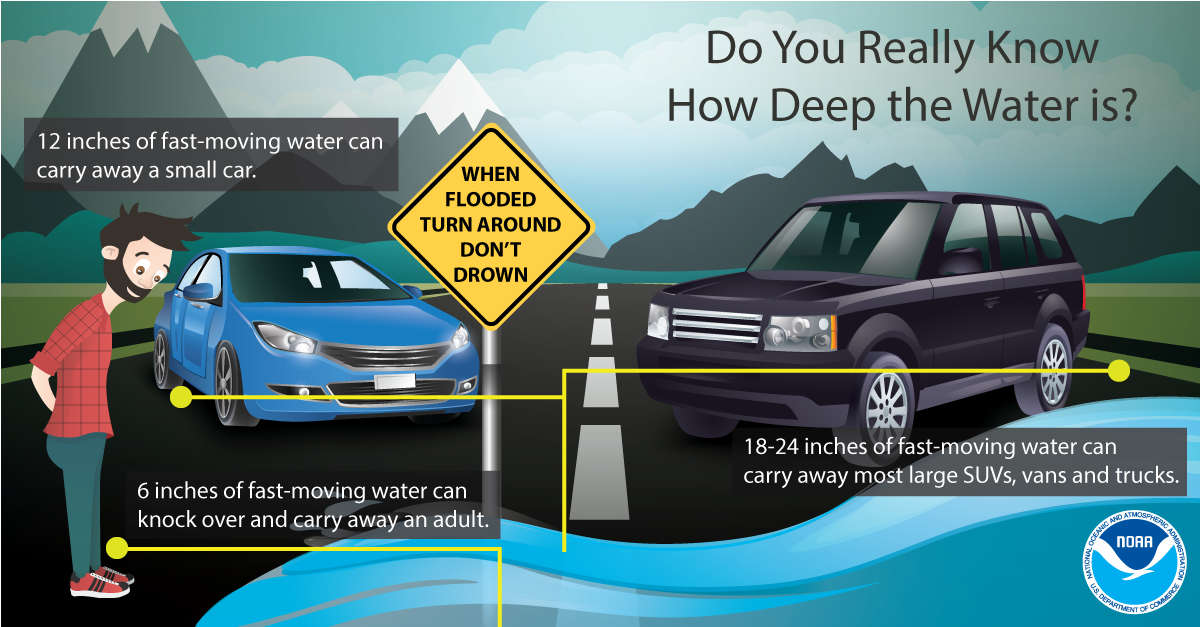

INDOT prepared for severe weather, widespread flooding through weekend

INDOT prepared for severe weather, widespread flooding through weekend