Tax abatements are used by city governments to entice companies to locate in their communities.

The City of Shelbyville has allotted millions of dollars in tax abatements over the years and it has resulted in several companies now calling Shelbyville home.

On Monday at City Hall, the Shelbyville Common Council approved a new ordinance that would allow the city to add a new caveat to the tax abatement process. For each year the company receives a tax abatement, typically over a 10-year period based on the city’s history, the company will pay the city 2% of the amount of taxes not being collected.

“Councilman (Brad) Ridgeway, years ago when he was on the council, proposed something very similar to this. We are giving money to all these companies, well what are we getting in return other than the product they are giving or the taxes they are paying?” said Shelbyville Mayor Scott Furgeson. “Franklin does something very similar to this.

“We are going to ask (the company) for whatever is abated, we will get 2% refunded back to the city. We will put that in an economic development fund to attract more industries or to do projects related to economic development in our community.”

The ordinance does not take effect until Jan. 1, 2025.

“Anything that is done now or anything done previously, there is nothing included in that,” said Furgeson.

Furgeson is unsure how much money the fund will accrue since it is all tied to new tax abatements.

Also on Monday, the council approved a resolution to support TWG Development’s project that will create more than 100 apartments on the city’s west side.

In June of 2023, TWG Development appeared before the council seeking to rezone the properties at 837 Webster and 875 Webster (photo) to create an affordable multi-family housing project.

The city has entered into a PILOT (Payment in Lieu of Taxes) agreement in a show of support for the project, which has yet to break ground.

“The city, as far as I know, has never done a payment in lieu of taxes,” said Furgeson. “We’ve offered TWG some dollars to help them do their project. We are going to give them their payments in lieu of taxes. So whatever they would pay into, it’s like a tax abatement but we are refunding the money to them. It’s payments in lieu of taxes.”

TWG Development is an Indianapolis-based firm that specializes in multi-family housing developments that it manages and maintains for a minimum of 15 years after construction completion.

The project, known as “Eight 37 Lofts,” is scheduled to break ground this year and be completed in the fall of 2025.

“They have turned their plans into the Plan Commission,” said Furgeson.

The Shelby County Post is a digital newspaper producing news, sports, obituaries and more without a pay wall or subscription needed. Get the most recent Shelby County Post headlines delivered to your email by visiting shelbycountypost.com and click on the free daily email signup link at the top of the page.

Joint Press Release: Evacuation Notice

Joint Press Release: Evacuation Notice

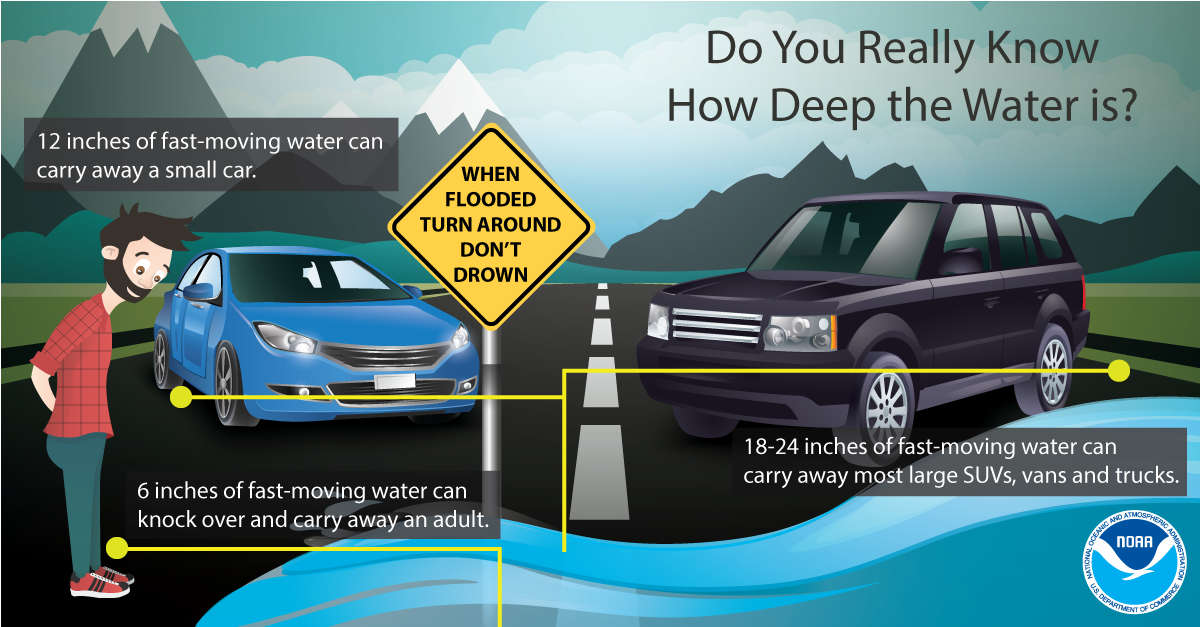

Flood Warning continues with more rain in weekend forecast

Flood Warning continues with more rain in weekend forecast

Indiana State Parks hiring for lifeguards at public pools and beaches

Indiana State Parks hiring for lifeguards at public pools and beaches

IDVA offers grant opportunities for non-profit organizations serving the Indiana Veteran Community

IDVA offers grant opportunities for non-profit organizations serving the Indiana Veteran Community

Gov. Braun activates Indiana National Guard to aid in storm recovery

Gov. Braun activates Indiana National Guard to aid in storm recovery

Passenger taken to IU-Methodist from two-vehicle Shelbyville crash

Passenger taken to IU-Methodist from two-vehicle Shelbyville crash

Shelbyville makes major advancement in public safety and emergency response times

Shelbyville makes major advancement in public safety and emergency response times

Registration open for Tree Trot 5K Run

Registration open for Tree Trot 5K Run